In-depth analysis of injection mold industry: current situation, challenges and opportunities

In-depth Analysis of the Injection Mold Industry: Current Situation, Challenges and Opportunities

I. Introduction

Injection molds, as indispensable key process equipment in industrial production, are widely used in numerous fields such as automobiles, home appliances, electronics, and packaging, playing a crucial role in promoting the development of the manufacturing industry. It can precisely manufacture plastic products of various shapes and sizes from plastic raw materials through injection molding. The quality and performance of these products directly affect the quality and market competitiveness of downstream products. Against the backdrop of the continuous upgrading and innovation of the global manufacturing industry, the injection mold industry is confronted with unprecedented opportunities and challenges. A thorough exploration of its current development status, market trends, and the problems it faces is of great practical significance for industry participants to grasp the development direction and make strategic decisions.

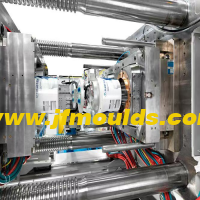

Auto Mould_Taizhou Jiefeng Mould Co.,Ltd. (jfmoulds.com)

Ii. Current Status of Industry Development

(1) Global market size and Growth trends

According to data from market research institutions, the global injection mold market size was approximately 30.37 billion US dollars in 2024 and is projected to reach 38.35 billion US dollars by 2031, with a compound annual growth rate (CAGR) of 3.4% during the period from 2025 to 2031. This growth trend reflects the continuous and stable demand for injection molds in the global manufacturing industry. With the rise of manufacturing in emerging economies and the industrial upgrading of traditional manufacturing countries, the injection mold market is expected to maintain a steady growth in the coming years.

(II) Analysis of Major Regional Markets

1. Asia-pacific region: The Asia-Pacific region is the world's largest injection mold market. Countries such as China, Japan, and South Korea hold significant positions in the field of injection mold manufacturing. China, with its vast manufacturing base, complete industrial chain support and continuously improving technological level, has become the core driving force of the injection mold market in the Asia-Pacific region. In recent years, China's injection mold industry has made remarkable progress in technological innovation, product quality and production efficiency. It not only meets the demands of the domestic market, but also has strong competitiveness in the international market. Japan and South Korea possess advanced technology and rich experience in the field of high-end injection molds, especially taking the lead in precision injection molds for automobiles, electronics and other industries.

2. Europe: Europe is a traditional advantageous region for injection molds. Countries such as Germany, Italy, and France have many well-known injection mold manufacturers. These enterprises, with their exquisite craftsmanship, advanced technology and strict quality control, occupy an important share in the global high-end injection mold market. However, in recent years, the growth rate of injection mold production in Europe has been on a downward trend, dropping from 4% in 2018 to -19% in 2020. The main reasons include intensified market competition, rising production costs, and the transfer of some manufacturing industries to emerging economies.

3. North America: The injection mold market in North America is mainly represented by the United States and Canada. As a global manufacturing power, the United States has a wide and high-end demand for injection molds, especially in the fields of automobiles, aerospace, and medical care. American injection mold enterprises attach great importance to technological research and development and innovation, and are at the forefront of the world in advanced manufacturing technology, material application and mold design. The injection mold industry in Canada is mainly concentrated in regions such as Ontario, closely cooperating with the manufacturing industry in the United States to provide injection mold supporting services for industries such as automotive parts and electronic products.

(III) Distribution of Application Fields

1. Household appliance market: In the field of household appliances, injection molds are widely used. From the shells of large household appliances such as refrigerators, washing machines, and air conditioners to the components of small household appliances such as rice cookers, microwave ovens, and hair dryers, none can do without the manufacturing of injection molds. At present, the household appliance market is the largest niche application market for injection molds, with a share of over 60%. As consumers' demands for the appearance design, functional diversity and quality of household appliances continue to rise, higher requirements have been put forward for the precision, complexity and surface quality of injection molds.

2. Automotive industry: The automotive industry is one of the important application fields of injection molds. Injection molds are widely used in automotive interior parts, exterior parts, engine components, etc. In developed countries in the automotive industry, injection molds account for 60% of automotive molds. However, the current degree of automotive lightweighting in China is still at a relatively low level compared to foreign countries, with the proportion of injection molds being less than 40%. But this also indicates that there is still considerable room for improvement in the application of injection molds in the automotive industry. With the rapid development of automotive lightweighting and new energy vehicles, the demand for injection molds will continue to grow. At the same time, it also poses higher challenges to the lightweight design of molds, the application of high-strength materials, and precision manufacturing technologies.

3. Electronic and electrical market: Plastic casings and components of electronic and electrical products such as smart phones, tablet computers, computers and peripheral products, household appliances, etc. all require injection molds for production. With the continuous development of electronic technology and the accelerated pace of product renewal, the demand for injection molds in the electronic and electrical market is characterized by diversification and personalization. At the same time, higher requirements have been put forward for the precision, miniaturization and production efficiency of molds to meet the development trend of electronic products becoming increasingly thinner, lighter and smaller.

4. Packaging Industry: The packaging industry is one of the traditional application fields of injection molds. Injection molds can be used to produce various plastic packaging containers, bottle caps, packaging boxes, etc. With the continuous improvement of the packaging industry's requirements for environmental protection, aesthetics, functionality and other aspects, the application of injection molds in the packaging field is also constantly innovating and expanding. For instance, develop new types of environmentally friendly plastic material injection molds to produce packaging products with special functions such as preservation, anti-counterfeiting, and easy opening.

Motorcycle Mould_Taizhou Jiefeng Mould Co.,Ltd. (jfmoulds.com)

Iii. Predicaments Faced by the Industry

(1) Intensified market competition and compressed profits

1. Overcapacity triggers a vicious cycle of price wars: In the domestic market, the problem of overcapacity in the injection mold industry is particularly prominent, especially in the two core industrial belts of the Pearl River Delta (Dongguan, Shenzhen) and the Yangtze River Delta (Ningbo, Taizhou), where the overcapacity is even more pronounced. There are over 8,000 mold enterprises in the Pearl River Delta alone, among which 60% are small and micro enterprises with an annual output value of less than 20 million yuan. The capacity utilization rate of homogeneous injection molds is only 65%. The overcapacity rate of home appliance and daily chemical molds in the Yangtze River Delta region has reached 40%. Overcapacity has led to fierce market competition. To compete for orders, enterprises have been cutting prices one after another. The main engine manufacturers have adopted the "N + 3" price comparison model (1 existing supplier + 3 new quotations) to force price cuts. The average annual decline in mold purchase prices is 5% to 8%. To pass on the pressure, first-tier suppliers demand that mold prices be reduced by 10% to 15%. This has forced small and medium-sized mold factories to cut prices in order to secure orders, creating a vicious cycle of low-price competition → insufficient profits → inability to invest in research and development (the proportion of R&D investment in the industry is only 1.2%) → technological stagnation → deeper price wars.

2. Double squeeze from international competition: In the international market, German and Japanese enterprises monopolize the high-end mold market (with a market share of over 60% for automotive precision molds) by virtue of their advanced technology and rich experience. Domestic mold enterprises have a considerable gap with international giants in terms of technology, brand and quality, making it difficult for them to compete. In the mid-to-low-end market, the labor cost advantage of Southeast Asian countries has become more prominent (the salary of a mold engineer in Vietnam is about one-third of that in China), further squeezing the international market survival space of domestic manufacturers and making it even more difficult for domestic molds to enter the international market.

(2) Bottlenecks in technological upgrading

Insufficient precision manufacturing capacity: There is a serious shortage of core equipment for injection mold processing. Some high-precision equipment relies on imports, and the precision of domestic equipment is insufficient. The digital design capability is weak. These factors have led to insufficient precision manufacturing capacity in the domestic injection mold industry, making it difficult to meet the requirements of high-end products for mold precision and surface quality, and hindering technological upgrading.

2. Lagging application of new materials: High-end materials for domestic injection molds rely on imports, the purity of domestic mold steel is low, and the research and development of special steel lags behind. Meanwhile, the application of additive manufacturing technologies such as conformal waterway technology and composite material molds in China has also encountered bottlenecks, lagging behind the international advanced level and failing to meet the market's demands for high-performance mold materials and advanced manufacturing technologies in a timely manner.

3. The predicament of intelligent transformation: Due to reasons such as the shortage of intelligent equipment and the restricted application of robots, the hardware penetration rate is low. Meanwhile, problems like data silos and the lack of knowledge management have led to the fragmentation of software systems, causing the intelligent transformation of the injection mold industry to encounter difficulties. In the process of promoting intelligent production, many enterprises encounter problems such as difficulties in equipment integration, insufficient data collection and analysis capabilities, and incomplete intelligent management systems, making it hard to effectively enhance production efficiency and quality.

4. Weak accumulation of process technology: The domestic injection mold industry is highly dependent on reverse engineering, with insufficient independent innovation. Compared with foreign countries, micro-forming technology has obvious shortcomings, and the accumulation of process technology is weak. In the process of mold design and manufacturing, the lack of in-depth research and application of advanced technological processes makes it difficult to achieve efficient and precise mold manufacturing, which has held back the technological progress of the industry.

5. Insufficient cross-disciplinary collaboration: The injection mold industry involves multiple disciplines such as mechanics, materials, electronics, and computer science. However, currently, there is a lack of cross-disciplinary collaboration within the domestic industry. Issues such as the failure of material-mold collaboration and the disconnection between products and molds exist, which affect the overall performance and quality of molds and hinder technological progress in the industry.

6. Talent structure gap: Young people are reluctant to enter the injection mold industry. The main reasons include relatively poor working environment, high labor intensity, uncompetitive salary and benefits, and unclear career development prospects. Meanwhile, the absence of a training system within the industry has led to a crisis of skill gap, lagging knowledge updates, and a shortage of high-quality technical and management talents, which has restricted the innovative development and technological upgrading of the industry.

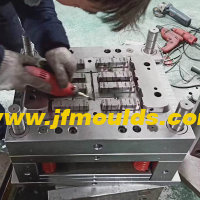

Processing equipment_Taizhou Jiefeng Mould Co.,Ltd. (jfmoulds.com)

(3) Deterioration of the cost structure

1.The runaway increase in raw material costs: The rise in the price of die steel and the inflation of auxiliary materials have led to a sharp increase in the cost of die raw materials. In recent years, due to factors such as fluctuations in international steel prices and tight supply of raw materials, the price of die steel has continued to rise, increasing the production costs of injection mold enterprises.

2. Sharp increase in energy and equipment costs: The rise in industrial electricity prices has led to the proportion of electrical discharge machining costs increasing from 8% to 15%. The increase in cutting fluid prices has led to a 40% rise in the cost of processing fluid consumption. The price of CNC equipment has increased by 30%, causing the equipment depreciation rate to rise from 12% to 18%. The significant increase in energy and equipment costs has brought considerable cost pressure to injection mold enterprises.

3. Structural contradiction in human resource costs: Skill premium and loss coexist. The salaries of senior mold designers have soared, but the talent gap remains significant. At the same time, the rising compliance costs, such as the increase in social security and housing provident fund expenses, have further increased the cost burden on enterprises. In addition, due to the fierce competition for industry talents and frequent employee turnover, enterprises are facing significant challenges in talent cultivation and retention.

4. Industrial chain transmission effect: The cost passing on by the main vehicle manufacturers and the deterioration of the payment cycle have made the mold industry bear more industrial chain costs. To cut their own costs, the main engine manufacturers have been constantly reducing the purchase price of molds and extending the payment cycle from the original 60 days to 180 days. This has led to tight cash flow for the mold factories and affected their normal production and operation as well as technological research and development investment.

5. Sharp increase in the cost of technological substitution: The rising cost of intelligent transformation and the out-of-control cost of trial and error have led to a sharp increase in the cost of technological substitution. In the process of promoting intelligent transformation, injection mold enterprises need to invest a large amount of funds in purchasing intelligent equipment, software systems and conducting technological research and development. However, due to reasons such as immature technology and unsatisfactory application effects, they often face high trial-and-error costs, which increase the burden on the enterprises.

6. Costs of international trade frictions: Factors such as tariff barriers and certification barriers in international trade frictions have increased the export costs and market risks of injection mold enterprises. In recent years, global trade protectionism has been on the rise. Some countries have imposed additional tariffs on Chinese injection mold products and set up certification barriers, which have restricted the international market expansion of Chinese injection mold enterprises.

(4) The predicament of industrial chain collaboration

The contradiction between fragmented demand and rigid supply chain: The order volume of new energy vehicle molds has dropped by 60%, the life cycle of individual items has been compressed from 5 years to 2-3 years, and the proportion of small-batch orders (< 10 sets) has reached 45%. However, the production lines of mold enterprises are still designed for more than 50 sets, resulting in low production efficiency and increased costs. Meanwhile, the product iteration cycle of the main engine manufacturers has been shortened to 8 months, and the material preparation cycle of mold enterprises needs to be advanced by 6 months. The proportion of mold modification costs due to demand changes in the total cost has risen from 18% to 32%, which brings significant difficulties to the production planning and cost control of mold enterprises.

2. Deterioration of cash flow triggers a crisis of trust: The payment period has been extended from 60 days to 180 days. The mold factory is facing tight cash flow and refuses to accept long-cycle orders. The proportion of quality guarantee deposit has been raised from 5% to 20%, which will occupy the working capital of enterprises and curb technological investment. The original equipment manufacturer unilaterally defined the standards for mold defects, and the dispute resolution took more than six months, which led to a decline in the willingness of both sides to cooperate and affected the coordinated development of the upstream and downstream of the industrial chain.

3. Technical standard segregation and data silos: The differences in mold acceptance standards among German, Japanese and domestic Oems amount to 40 items (such as parting surface fit tolerance ±0.02mm vs ±0.05mm), and 70% of mold factories need to maintain more than three sets of design specifications simultaneously, increasing labor costs by 20%. The main engine manufacturers use NX, while mold factories mostly use UG. The data conversion loss accuracy can reach 0.01mm. The matching rate between CAE simulation data and processing equipment parameters is less than 50%, which leads to a threefold increase in the number of mold trials, reducing production efficiency and product quality.

4. Distorted benefit distribution mechanism: The main engine manufacturers demand an annual price reduction of 8-12%, but the cost of raw materials such as mold steel rises by 15%, which severely compresses the profit margins of mold enterprises. The profit distribution ratio is unbalanced, with 52% for the original equipment manufacturers, 30% for the first-tier suppliers, and only 18% for the mold factories. Meanwhile, the mainframe manufacturers have transferred 90% of the inventory pressure to the mold factories (the VMI model has a penetration rate of 60%), and the mold factories bear 80% of the risks in the development of new materials (for instance, the failure rate of carbon fiber reinforced plastic mold trials exceeds 70%), further intensifying the contradictions between the upstream and downstream of the industrial chain.

5. Capability mismatch and response delay: The proportion of mold factories involved in the product design stage is less than 20%, resulting in a fivefold increase in later modification costs. The mold development cycle for new processes such as liquid silicone rubber (LSR) is 40% longer than that of Japanese enterprises, and the technical response speed is slow. The proportion of urgent orders from the main engine manufacturers has reached 35%, but the equipment switching time of the mold factories exceeds 48 hours, and the capacity allocation is rigid. Due to intellectual property disputes, the equipment sharing rate of the shared manufacturing platform is less than 25%, which cannot meet the market demand in a timely manner.

6. Absence of an ecosystem collaboration mechanism: The conversion rate of mold research achievements from universities is less than 10%, the matching degree of enterprise demands is less than 30%, the number of joint laboratories only accounts for 5% of the industry's technical investment projects, and there is a serious disconnection between industry, academia and research. The transaction proportion of the mold industry Internet platform is less than 3% (due to data security concerns). Among the 112 standards formulated by the regional mold alliance, the actual implementation rate is only 38%. The industry platform has failed and lacks an effective ecosystem collaboration mechanism, which has restricted the innovative development and overall competitiveness improvement of the industry.

Related News

Injection mold industry: Breaking through technological barriers and seizing the new track of intelligent manufacturing

2025-07-01

Injection mold industry: Breaking through technological barriers and seizing the...

In-depth Insights into the Injection Mold Industry: Technological Iteration, Market Landscape, and New Paradigms for Sustainable Development

2025-07-03

In-depth Insights into the Injection Mold Industry: Technological Iteration, Mar...

Injection molds: The Cornerstone and Future Trend of Precision Manufacturing

2025-07-12

Injection molds: The Cornerstone and Future Trend of Precision ManufacturingBasi...

From the basics to applications, how does it affect our lives

2025-07-17

From the basics to applications, how does it affect our livesThe basic concepts ...

Solution for mold fracture and air wrinkle treatment

2025-08-08

Solution for mold fracture and air wrinkle treatmentFracture of the moldPhenomen...

In-depth Analysis of the Injection Mold Industry

2025-07-01

In-depth Analysis of the Injection Mold IndustryI. Overview of the Injection Mol...